The Nexus Between National Security Risks and Financial Market Stability: Evidence from Emerging Economies

Nexus Between National Security Risks and Financial Market Stability

DOI:

https://doi.org/10.63841/iue24524Keywords:

Geopolitical uncertainty, cybersecurity threats, market volatility index (VIX), foreign direct investment (FDI), panel data analysisAbstract

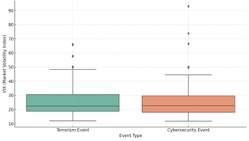

Financial market stability in emerging economies is increasingly threatened by the rising complexity of national security risks. While economic indicators have long been studied as drivers of market behavior, recent global trends highlight the growing influence of political and digital threats on financial volatility. Among these, geopolitical tensions, terrorism, and cybersecurity breaches pose distinct and interconnected challenges to investor confidence and economic performance. Despite a growing body of research, the comparative impact of multiple security risks on market volatility remains underexplored, particularly in the context of structurally vulnerable emerging markets. Here we show that geopolitical risk is the most consistent and statistically significant driver of financial market volatility, while terrorism and cybersecurity incidents exert more episodic and context-specific effects.

These findings are derived from panel regression models using data from 2013 to 2024 across emerging economies, supported by robustness checks and visual analyses. Unlike previous studies that focus on isolated threats, our results reveal that macroeconomic fundamental—especially GDP growth and FDI inflows—serve as important stabilizing forces, mitigating the disruptive effects of security risks. By integrating multiple dimensions of national security threats into a unified empirical framework, this study offers a clearer understanding of how political and digital instability affects financial systems. The results hold practical value for policymakers and investors seeking to develop resilient strategies in increasingly uncertain global environments.

Downloads

References

A. A. Darem, A. A. Alhashmi, T. M. Alkhaldi, A. M. Alashjaee, S. M. Alanazi, and S. A. Ebad, “Cyber Threats Classifications and Countermeasures in Banking and Financial Sector,” IEEE Access, vol. 11, pp. 125138–125158, 2023, doi: 10.1109/ACCESS.2023.3327016.

R. Bouhia and P. Kaczmarczyk, “Buckle Up, It’s a Bumpy Ride: Financial Instability and Volatility in Developing and Emerging Economies,” Social Science Research Network, Jan. 2021, doi: 10.2139/SSRN.4047179.

M. Khraiche, J. W. Boudreau, and M. S. R. Chowdhury, “Geopolitical risk and stock market development,” Journal of International Financial Markets, Institutions and Money, vol. 88, Sep. 2023, doi: 10.1016/J.INTFIN.2023.101847.

T. NguyenHuu and D. K. Örsal, “Geopolitical risks and financial stress in emerging economies,” World Econ, vol. 47, no. 1, pp. 217–237, Oct. 2023, doi: 10.1111/TWEC.13529.

T. Walker, D. Gramlich, K. Vico, and A. Dumont-Bergeron, “Emerging Risks: An Overview,” Palgrave Studies in Sustainable Business in Association with Future Earth, pp. 1–10, Jan. 2020, doi: 10.1007/978-3-030-38858-4_1.

J. R. Francis and R. C.-J. Chia, “Geopolitical Risk (GPR) and its Predictability: A Systematic Literature Review,” International journal of academic research in business & social sciences, vol. 13, no. 9, Sep. 2023, doi: 10.6007/IJARBSS/V13-I9/16766.

D. Caldara and M. Iacoviello, “Measuring Geopolitical Risk,” Social Science Research Network, vol. 2018, no. 1222, pp. 1–66, Feb. 2018, doi: 10.17016/IFDP.2018.1222.

C. Seabra and M. E. Korstanje, “Terrorism and Tourism: Still Connecting the Dots,” Safety and Tourism: A Global Industry with Global Risks, pp. 77–101, Feb. 2023, doi: 10.1108/978-1-80382-811-420231005.

T. Hasso, M. Pelster, and B. Breitmayer, “Terror attacks and individual investor behavior: Evidence from the 2015–2017 European terror attacks,” J Behav Exp Finance, vol. 28, p. 100397, Dec. 2020, doi: 10.1016/J.JBEF.2020.100397.

J. Goh et al., “Cyber Risk Surveillance,” IMF Working Papers, vol. 20, no. 28, Feb. 2020, doi: 10.5089/9781513526317.001.

F. Curti, J. Gerlach, S. Kazinnik, M. Lee, and A. Mihov, “Cyber risk definition and classification for financial risk management,” Journal of Operational Risk, vol. 18, no. 2, pp. 37–58, 2023, doi: 10.21314/JOP.2022.036.

M. R. R. Megananda and S. Sutrisno, “Factors Affecting Stock Investment by Individual Investors on the Indonesia Stock Exchange,” International Journal of Management and Economics Invention, vol. 10, no. 10, Oct. 2024, doi: 10.47191/IJMEI/V10I10.06.

H. Natahadi, M. Makaryanawati, and K. B. Keliwon, “Impact of Influencer Trustworthiness and Financial Literacy on Herding Behavior with Risk Perception Mediating Variables of Indonesian Millennial Investors,” International Journal of Social Service and Research, vol. 4, no. 01, pp. 15–30, Jan. 2024, doi: 10.46799/IJSSR.V4I01.648.

M. A. W. Sinaga, N. F. Nuzula, and C. R. Damayanti, “The Psychology of Risk Influence and Investor Sentiment on Investment Decision Making in the Indonesian Stock Market,” Jurnal Ilmiah Akuntansi Dan Bisnis, vol. 18, no. 2, p. 197, Jul. 2023, doi: 10.24843/JIAB.2023.V18.I02.P01.

F. Ben Moussa and M. Talbi, “Strategic Deployment of Investments in Critical Financial Infrastructure for Long-Term Economic Stability and Market Competitiveness,” International Journal of Computer Applications Technology and Research, Mar. 2025, doi: 10.7753/IJCATR1006.1009.

D. Talbi, H. Chaibi, and A. Maoueti, “Political uncertainty, financial crises, and stock market volatility: Evidence from MENA region,” J Public Aff, vol. 22, no. S1, Dec. 2022, doi: 10.1002/PA.2783.

E. O. Abanikanda and J. T. Dada, “External shocks and macroeconomic volatility in Nigeria: does financial development moderate the effect?,” PSU Research Review, vol. 8, no. 3, Nov. 2023, doi: 10.1108/PRR-07-2022-0094.

A. H. Elsayed and M. H. Helmi, “Volatility transmission and spillover dynamics across financial markets: the role of geopolitical risk,” Ann Oper Res, vol. 305, no. 1–2, Oct. 2021, doi: 10.1007/S10479-021-04081-5.

J. Micallef, S. Grima, J. Spiteri, and R. Rupeika-Apoga, “Assessing the Causality Relationship between the Geopolitical Risk Index and the Agricultural Commodity Markets,” Risks, vol. 11, no. 5, May 2023, doi: 10.3390/RISKS11050084.

S. K. Oad Rajput, A. A. Memon, T. A. Siyal, and N. K. Bajaj, “Volatility spillovers among Islamic countries and geopolitical risk,” Journal of Islamic Accounting and Business Research, vol. 15, no. 5, pp. 729–745, May 2024, doi: 10.1108/JIABR-07-2022-0173.

Z. Y. Ren, Y. J. Chen, C. Y. Hsiao, and C. Liao, “Risk Spillover Effects of International Risk Factors on China’s Energy Market - Based on Geopolitical Threats and Shipping Markets,” Apr. 2024, doi: 10.21203/RS.3.RS-4227279/V1.

M. Yang, Q. Zhang, A. Yi, and P. Peng, “Geopolitical Risk and Stock Market Volatility in Emerging Economies: Evidence from GARCH-MIDAS Model,” Discrete Dyn Nat Soc, vol. 2021, 2021, doi: 10.1155/2021/1159358.

Z. Lu, G. Gozgor, M. Huang, and M. C. Keung Lau, “The Impact of Geopolitical Risks on Financial Development: Evidence from Emerging Markets,” Journal of Competitiveness, vol. 12, no. 1, pp. 93–107, Mar. 2020, doi: 10.7441/JOC.2020.01.06.

A. Nasouri, “The Impact of Geopolitical Risks on Equity Markets and Financial Stress: A Comparative Analysis of Emerging and Advanced Economies,” International Journal of Economics and Business Administration, vol. XIII, no. Issue 1, pp. 30–41, Feb. 2025, doi: 10.35808/IJEBA/873.

M. Hodula, J. Janků, S. Malovana, and N. A. Ngo, “Geopolitical Risks and Their Impact on Global Macro-financial Stability: Literature and Measurements,” Sep. 2024, doi: 10.2139/SSRN.4968346.

C. Bouras, C. Christou, R. Gupta, and T. Suleman, “Geopolitical Risks, Returns, and Volatility in Emerging Stock Markets: Evidence from a Panel GARCH Model,” Emerging Markets Finance and Trade, vol. 55, no. 8, pp. 1841–1856, Jun. 2019, doi: 10.1080/1540496X.2018.1507906.

L. F. de Paula, B. Fritz, and D. M. Prates, “Keynes at the periphery: Currency hierarchy and challenges for economic policy in emerging economies,” J Post Keynes Econ, vol. 40, no. 2, pp. 183–202, Apr. 2017, doi: 10.1080/01603477.2016.1252267.

O. Gharaibeh and B. Kharabsheh, “Geopolitical Risks, Returns, and Volatility in the MENA Financial Markets: Evidence from GARCH and EGARCH Models,” Montenegrin Journal of Economics, vol. 19, no. 3, pp. 21–36, 2023, doi: 10.14254/1800-5845/2023.19-3.2.

M. Hu and X. Yuan, “Dollar shocks and cross-border capital flows: Evidence from 33 emerging economies,” PLoS One, vol. 20, no. 3, Mar. 2025, doi: 10.1371/JOURNAL.PONE.0319570.

B. N. Iyke, D. H. B. Phan, and P. K. Narayan, “Exchange rate return predictability in times of geopolitical risk,” International Review of Financial Analysis, vol. 81, May 2022, doi: 10.1016/j.irfa.2022.102099.

S. K. Agyei, “Emerging markets equities’ response to geopolitical risk: Time-frequency evidence from the Russian-Ukrainian conflict era,” Heliyon, vol. 9, no. 2, p. e13319, Feb. 2023, doi: 10.1016/j.heliyon. 2023. e13319.

A. A. Salisu, A. E. Ogbonna, L. Lasisi, and A. Olaniran, “Geopolitical risk and stock market volatility in emerging markets: A GARCH – MIDAS approach,” The North American Journal of Economics and Finance, vol. 62, p. 101755, Nov. 2022, doi: 10.1016/J.NAJEF.2022.101755.

M. C. De Wet, “Geopolitical Risks and Yield Dynamics in the Australian Sovereign Bond Market,” Journal of Risk and Financial Management, vol. 16, no. 3, Mar. 2023, doi: 10.3390/JRFM16030144.

N. Naifar and S. Aljarba, “Does Geopolitical Risk Matter for Sovereign Credit Risk? Fresh Evidence from Nonlinear Analysis,” Journal of Risk and Financial Management, vol. 16, no. 3, Mar. 2023, doi: 10.3390/JRFM16030148.

F. Owusu, “Analysis of Market Volatility and Economic Factors in Emerging Markets,” International Journal of Modern Risk Management, vol. 1, no. 1, Sep. 2023, doi: 10.47604/IJMRM.2093.

W. Tan, W. Wang, and W. Zhang, “The Effects of Terrorist Attacks on Supplier–Customer Relationships,” Prod Oper Manag, vol. 33, no. 1, pp. 146–165, Jan. 2024, doi: 10.1177/10591478231224920.

I. Arif and T. Suleman, “Terrorism and Stock Market Linkages: An Empirical Study from a Front-line State,” Global Business Review, vol. 18, no. 2, pp. 365–378, Apr. 2017, doi: 10.1177/0972150916668604.

N. Renzhi and J. Beirne, “Global Shocks and Monetary Policy Transmission in Emerging Markets,” May 2024, doi: 10.22617/WPS240272-2.

G. Saad, “Terrorism and its impact on the stock market: broad results from Tunisia,” LBS Journal of Management & Research, vol. 22, no. 1, pp. 110–125, Jul. 2024, doi: 10.1108/LBSJMR-12-2022-0079.

R. Kousar, Z. Imran, Q. M. Khan, and H. Khurram, “Impact of Terrorism on Stock Market: A Case of South Asian Stock Markets,” Journal of Accounting and Finance in Emerging Economies, vol. 5, no. 2, pp. 215–242, Dec. 2019, doi: 10.26710/jafee.v5i2.852.

A. J. Egwakhe and K. Odunsi, “Foreign Direct Investment and Tax Revenue Performance in Nigeria (1987-2016): Terrorism-Effect,” International Journal of Management Excellence, vol. 13, no. 2, pp. 1922–1929, Aug. 2019, doi: 10.17722/IJME.V13I2.1100.

M. N. Radić, “Terrorism as a Determinant of Attracting FDI in Tourism: Panel Analysis,” Sustainability, vol. 10, no. 12, Dec. 2018, doi: 10.3390/SU10124553.

I. G. N. P. Widiatedja and I. N. Suyatna, “Job Creation Law and Foreign Direct Investment in Tourism in Indonesia: Is It Better than Before?,” Udayana Journal of Law and Culture, vol. 6, no. 1, pp. 62–82, Jan. 2022, doi: 10.24843/UJLC.2022.V06.I01.P04.

Z. Taylor, “Behavioral Finance: Investor Psychology and Market Outcomes,” International Journal of Finance, vol. 9, no. 4, pp. 21–34, Jul. 2024, doi: 10.47941/IJF.2113.

S. F. Purba, C. Permatasari, I. Mudrawan, and B. M. T. V. Simandjorang, “The Impact of Fiscal Balance Funds Toward Human Development in Riau Province,” Jurnal Bina Praja, vol. 15, no. 2, pp. 275–288, Aug. 2023, doi: 10.21787/JBP.15.2023.275-288.

B. T. Familoni and P. O. Shoetan, “Cybersecurity in the Financial Sector: A Comparative Analysis of the Usa and Nigeria,” Computer Science &Amp; IT Research Journal, vol. 5, no. 4, pp. 850–877, Apr. 2024, doi: 10.51594/CSITRJ.V5I4.1046.

S. A. Daniel and S. S. Victor, “Emerging Trends in Cybersecurity for Critical Infrastructure Protection: A Comprehensive Review,” Computer Science &Amp; IT Research Journal, vol. 5, no. 3, pp. 576–593, Mar. 2024, doi: 10.51594/CSITRJ.V5I3.872.

B. Gaies and N. Chaâbane, “The dance of dependence: a macro-perspective on financial instability and its complex influence on the Euro-American green markets,” Journal of Economic Studies, vol. 51, no. 3, pp. 546–568, Apr. 2024, doi: 10.1108/JES-03-2023-0158.

B. Zhang, X. Xie, and C. Li, “How Connected Is China’s Systemic Financial Risk Contagion Network? A Dynamic Network Perspective Analysis,” Mathematics, vol. 11, no. 10, May 2023, doi: 10.3390/MATH11102267.

G. C. Landi, F. Iandolo, A. Renzi, and A. Rey, “Embedding sustainability in risk management: The impact of environmental, social, and governance ratings on corporate financial risk,” Corp Soc Responsib Environ Manag, vol. 29, no. 4, pp. 1096–1107, Jul. 2022, doi: 10.1002/CSR.2256.

D. Macek and S. Vitásek, “ESG risk analysis and preparedness of companies in the Czech Republic,” International Journal of Economic Sciences, vol. 13, no. 2, pp. 38–54, Dec. 2024, doi: 10.52950/ES.2024.13.2.003.

O. Chimezie, O. V. Akagha, S. O. Dawodu, A. Anyanwu, S. Onwusinkwue, and I. A. I. Ahmad, “Comprehensive Review on Cybersecurity: Modern Threats and Advanced Defense Strategies,” Computer Science &Amp; IT Research Journal, vol. 5, no. 2, pp. 293–310, Feb. 2024, doi: 10.51594/CSITRJ.V5I2.758.

M. Nabil, “The Effect of Political Risk on Financial Stability in MENA Region,” Int J Econ Finance, vol. 16, no. 10, p. 82, Sep. 2024, doi: 10.5539/IJEF.V16N10P82.

G. Singh, A. Wilson, and A. Halari, “The efficacy of macroeconomic policies in resolving financial market disequilibria: A cross‐country analysis,” International Journal of Finance &Amp; Economics, vol. 24, no. 1, pp. 647–667, Jan. 2019, doi: 10.1002/IJFE.1684.

K. Jebran and S. Chen, “Can we learn lessons from the past? COVID‐19 crisis and corporate governance responses,” International Journal of Finance &Amp; Economics, vol. 28, no. 1, pp. 421–429, Jan. 2023, doi: 10.1002/IJFE.2428.

F. Morais, Z. Serrasqueiro, and J. J. S. Ramalho, “The heterogeneous effect of governance mechanisms on zero-leverage phenomenon across financial systems,” Corporate Governance: The International Journal of Business in Society, vol. 22, no. 1, pp. 67–88, Jan. 2022, doi: 10.1108/CG-10-2020-0443.

J. A. Jaramillo-Restrepo, M. Jiménez-Gómez, and N. Acevedo-Prins, “Stock portfolio hedging with financial options,” Indonesian Journal of Electrical Engineering and Computer Science, vol. 19, no. 3, pp. 1436–1443, Sep. 2020, doi: 10.11591/IJEECS.V19. I3.PP1436-1443.

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Academic Journal of International University of Erbil

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.